Financial reports are an essential tool for businesses to track their financial performance and make informed decisions. Understanding the information contained in these reports is critical for ensuring the long-term success of your business. In this blog post, we will provide an overview of the most common financial reports and how to read them.

Income Statement:

The income statement, also known as the profit and loss statement, shows the revenue, expenses, and net income of a business over a specific period. It is a useful tool for understanding the profitability of your business. The income statement typically includes the following sections:

- Revenue: This section includes all income generated by the business during the reporting period.

- Cost of Goods Sold (COGS): This section includes the direct costs associated with producing the goods or services sold by the business.

- Gross Profit: This is the difference between revenue and COGS.

- Operating Expenses: This section includes all the expenses incurred in running the business, such as rent, utilities, salaries, and marketing.

- Net Income: This is the final figure, which represents the profit or loss of the business for the reporting period.

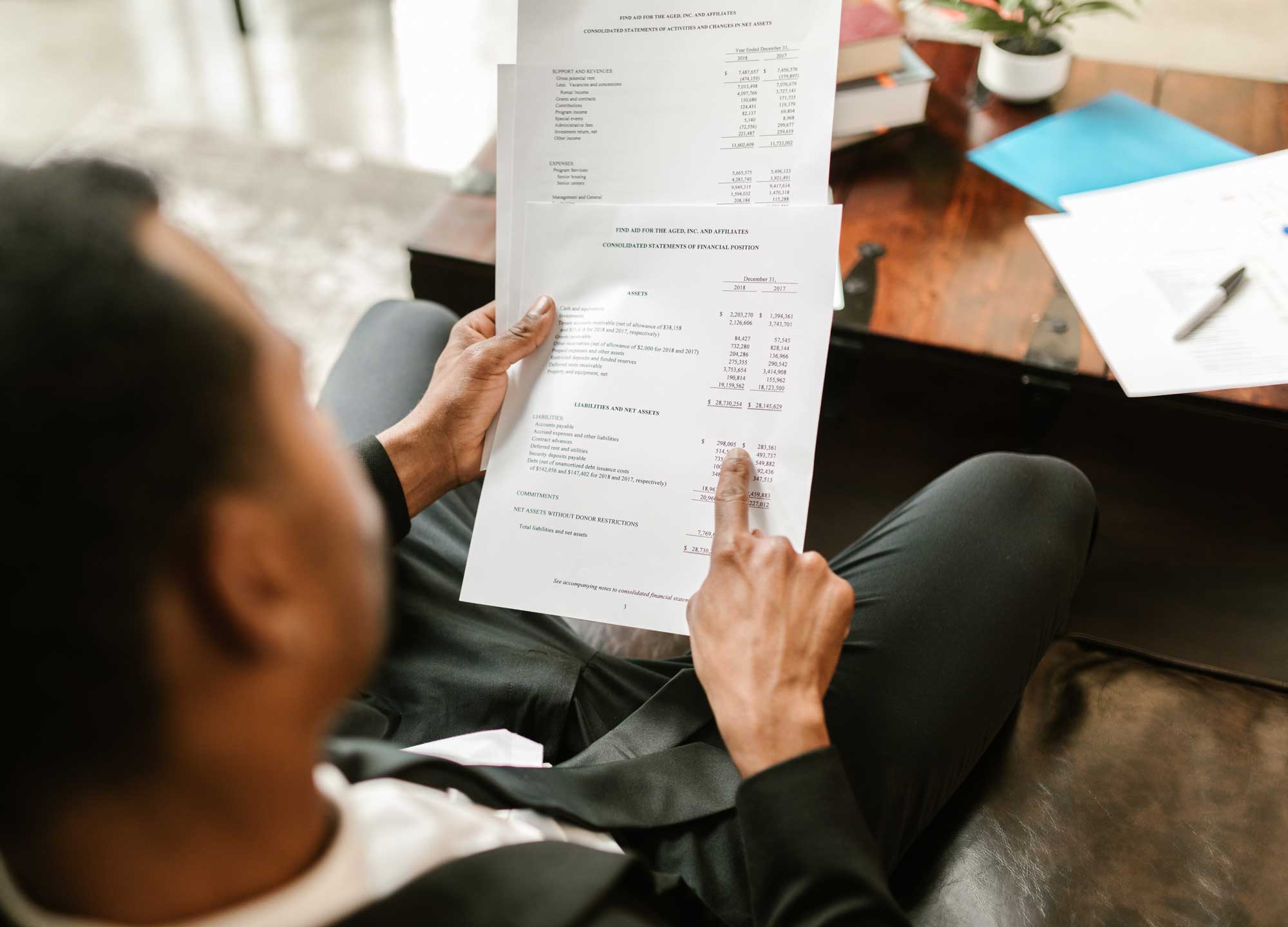

Balance Sheet:

The balance sheet provides a snapshot of the financial position of a business at a specific point in time. It shows the assets, liabilities, and equity of the business. The balance sheet typically includes the following sections:

- Assets: This section includes all the resources owned by the business, such as cash, inventory, and property.

- Liabilities: This section includes all the debts owed by the business, such as loans, accounts payable, and taxes.

- Equity: This section shows the ownership interest in the business, which is the difference between assets and liabilities.

Cash Flow Statement:

The cash flow statement shows the inflows and outflows of cash for a business over a specific period. It is a useful tool for understanding the liquidity of your business. The cash flow statement typically includes the following sections:

- Operating Activities: This section shows the cash generated or used by the business in its day-to-day operations, such as sales and expenses.

- Investing Activities: This section shows the cash generated or used by the business in investments, such as buying or selling assets.

- Financing Activities: This section shows the cash generated or used by the business in financing activities, such as borrowing or repaying loans.

How to Read Financial Reports:

Reading financial reports can be intimidating, but with a little practice, you can quickly become comfortable with them. Here are a few tips to get you started:

- Focus on the big picture: Look at the overall trends and patterns in the financial statements, rather than getting bogged down in the details.

- Compare to previous periods: Compare the current financial statements to previous periods to identify changes and trends.

- Look for anomalies: Pay attention to any unusual or unexpected figures, as they may indicate issues that need to be addressed.

- Use ratios: Financial ratios can help you interpret the data in financial statements and compare your business’s performance to industry benchmarks.

In conclusion, understanding financial reports is critical for managing your business effectively. By familiarizing yourself with the information contained in the income statement, balance sheet, and cash flow statement, you can gain valuable insights into your business’s financial performance and make informed decisions for the future.